Hi, since we are making some updates,

came out the old argument about the discount/taxing order. We need to agree on how to proceed.

As of right now, IP calculates discount on “gross prices”, which is fine for DE but a problem to everybody else,

who I hear, are using negative price rows to discount.

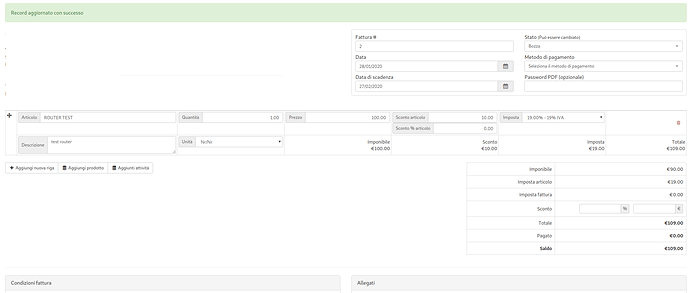

Look at this example,

Example Discount-Before-Tax:

price: 100 euro

discount: 10 euro discount

taxes: 19% taxes

taxable amount (tax base) = 100 - 10 = 90

final price = 90 + (90 / 100 * 19) = 107.1 euro

Example Discount-After-Tax:

price: 100 euro

discount: 10 euro discount

taxes: 19% taxes

final price = (100 + (100 / 100 * 19)) - 10 = 109 euro

In the first example, the customer is paying 90 of the item, plus 19% of 90 euro of taxes.

In the second example, we are basically still paying 90 for the item, but we are paying 19% of 100 euros (not 90!), giving the govt. more money then they deserve.

Should IP have a setting that switches “discount net amount”, “discount taxed amount” or something similar?

What should be the default?

I can make the PR if we all agree.

What do you think?