I’m sorry but I have difficulties getting to your point of view, explain the points of discussion clearly.

I don’t say your calculations are incorrect | There was some calculation problems I remember, and there always will be if this decision is not made.

If this calculation problem is what I’ve got in my notes, there is no problem, if you remember you should point out what it is clearly (use an example).

But there is no such thing as after-tax and before-tax.

After-tax is plain wrong, what @M4rt1n was intending previously in the discussion was the to offset the discount by an x amount to have the discount cut from the final price, but it is still calculating discount before tax. Both systems are Before tax.

95% of the people of the world will use the regular calculation, I call them Before/After for a practical reason, but in practice, the difference is to calculate discount from the net price or the total.

there should be only item-tax (with chosen different tax values) OR invoice-tax with chosen tax values. So the choice must not be before-tax OR after-tax. But item-tax OR invoice-tax. Then you solve the problem for good.

Wait a second, hold the horses. Those things have nothing to do with each other.

Before/After-tax is the calculation you do to produce the final price based on the tax and discount.

Item/Invoice-tax is a basic tax setting row-by-row or the whole invoice.

These are not interchangeable and not a solution for the problem of the other.

Also, there is to say the importance of an invoice tax is limited since if all the items have same tax you would end up with the same operation. And you can preset a tax value for the article, so you don’t have to input them one-by-one. The invoice tax is there if you have to act on the total. (Or at least in my mind)

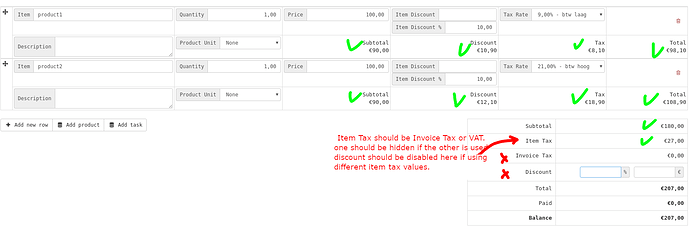

Image 1:

Item tax represents the amount of money, out of the total, going into taxes from the item:

27,00 = 8,10 + 18.90

It’s correctly called Item Tax, maybe could be called Item Tax Total??

Invoice tax it’s an additional tax you apply on the subtotal, so if you were to apply 9% on this 180 invoice it would be 16.20.

So they are named correctly, and there is a chance you are gonna be using both, so why rename/hide them?

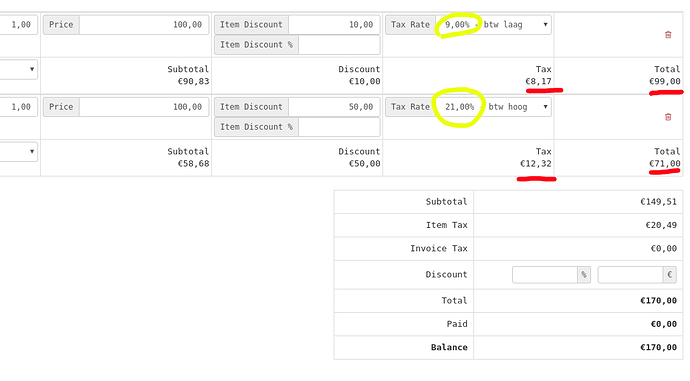

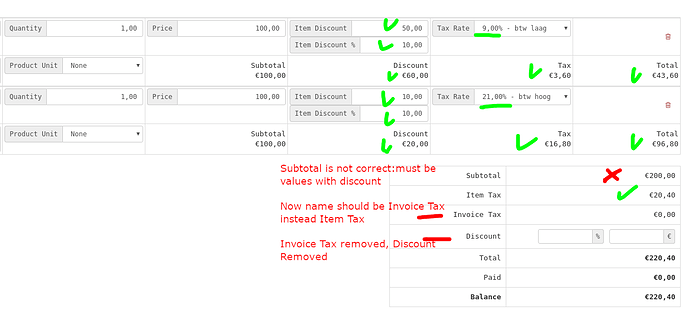

Image 2:

Here is probably the calculation error you were pointing out last time, you are using the “After tax” formula set by default,

so it’s calculated like this:

109 - 10 = (100 - x) + ((100 - x) / 100 * 9)

109 - 10 = 90.82 + (90.82 / 100 * 9)

99 = 90.82 + 8.17

and

121 - 50 = (100 - x) + ((100 - x) / 100 * 21)

121 - 50 = 58.67 + (58.67 / 100 * 21)

71 = 58.67 + 12.32

It’s correct if you want to switch to the standard use the setting.

Otherwise, we should discuss what should be the default.

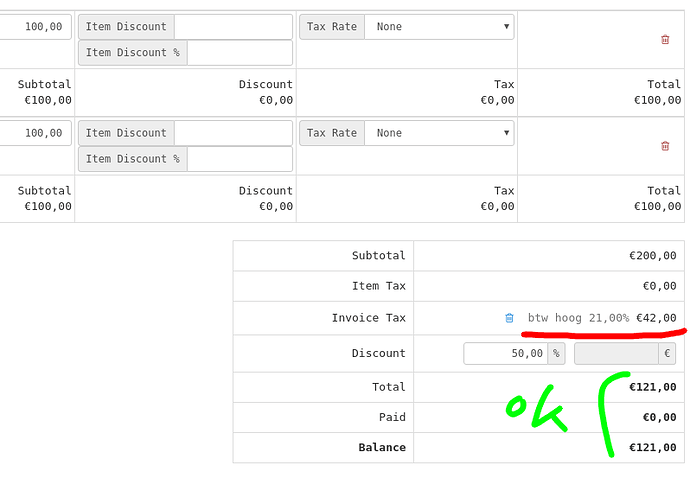

Image 3:

That’s a problem.

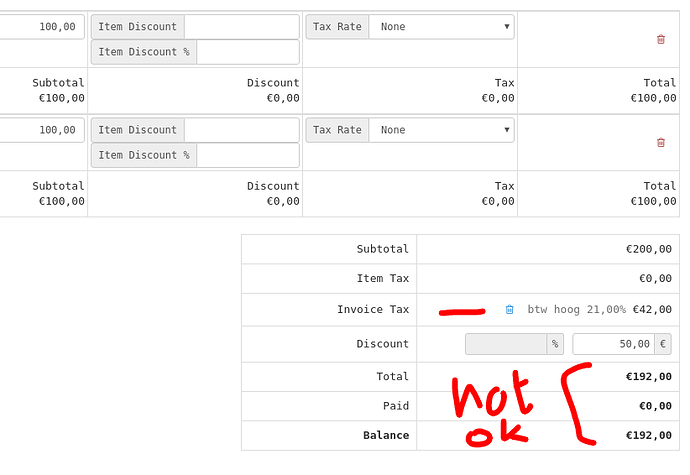

Image 4:

That’s a problem.

Image 6:

Same image as 4.

Image 7:

Same image as 3.

Image 8:

Subtotal is correnct, we should not rename any of the others.

So in conclusion, as I said, fix the totals displaying more info, to be clearer.

Tell me if you object.